- Government Fees

The Portuguese government charges an application fee per initial and renewal application, a residence permit initial issue fee per holder and a permit renewal fee at each renewal. Such fees are as follows:Application fee : €533.90 by the main applicant (investor) and €83.30 per additional applicant (dependent family member)

Permit issue fee : €5,336.40 per person for the initial permit and €2,6668.20 per person at each renewal. The Government application fees for permanent residency and for citizenship, which can be granted after the Golden Visa 5-year period, are considerably lower (a few hundred euros per applicant).

- Professional Fees

You will need to take into account the cost of at least the following professional services:

– Professional assistance with your Golden Visa initial application, renewals, permanent residency application and citizenship application

– Translation and legalisation of documents- Tax representation- Annual tax return preparation and filing in case you have Portugal

-Source income that is not subject to autonomous tax withheld at source, such as rents

– If you choose the real estate investment route, professional assistance with the purchase (and possibly renting) of property

-Professional assistance with setting up and running a company, if you choose to set up or buy a businessProperty Purchase Taxes Stamp duty (“imposto de selo”) at the rate of 0.8% of the transaction value applies in Portugal to the purchase of a property.In addition, we have the most significant tax – property transfer tax (“IMT”) – , which also applies to a property purchase.

While there are variations according to property type (rural, commercial/industrial or residential), property status (rehabilitated properties may benefit from exemptions) and property intended use (property intended as the permanent residence of the purchaser benefits from slightly lower rates), the typical situation is that of a new residential property not intended as the owner’s permanent residence.

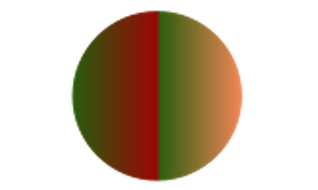

For the purchase of such property, the applicable transfer tax rates are those indicated on this page